Why Monte Carlo Simulation Matters for Retirement Planning

Traditional retirement calculators give you a single number based on average returns: "If your portfolio grows at 7% per year, you'll have $X at retirement." But real markets don't work that way.

Markets have bear markets, bull markets, recessions, and booms. The sequence of these returns matters enormously - retiring right before a crash produces very different outcomes than retiring at a market peak.

Monte Carlo simulation runs your retirement plan through thousands of possible market scenarios to show you the full range of outcomes - from best case to worst case. This reveals critical risks that traditional calculators completely miss.

Below are two real examples showing how Monte Carlo analysis provides a more honest picture than simple linear projections:

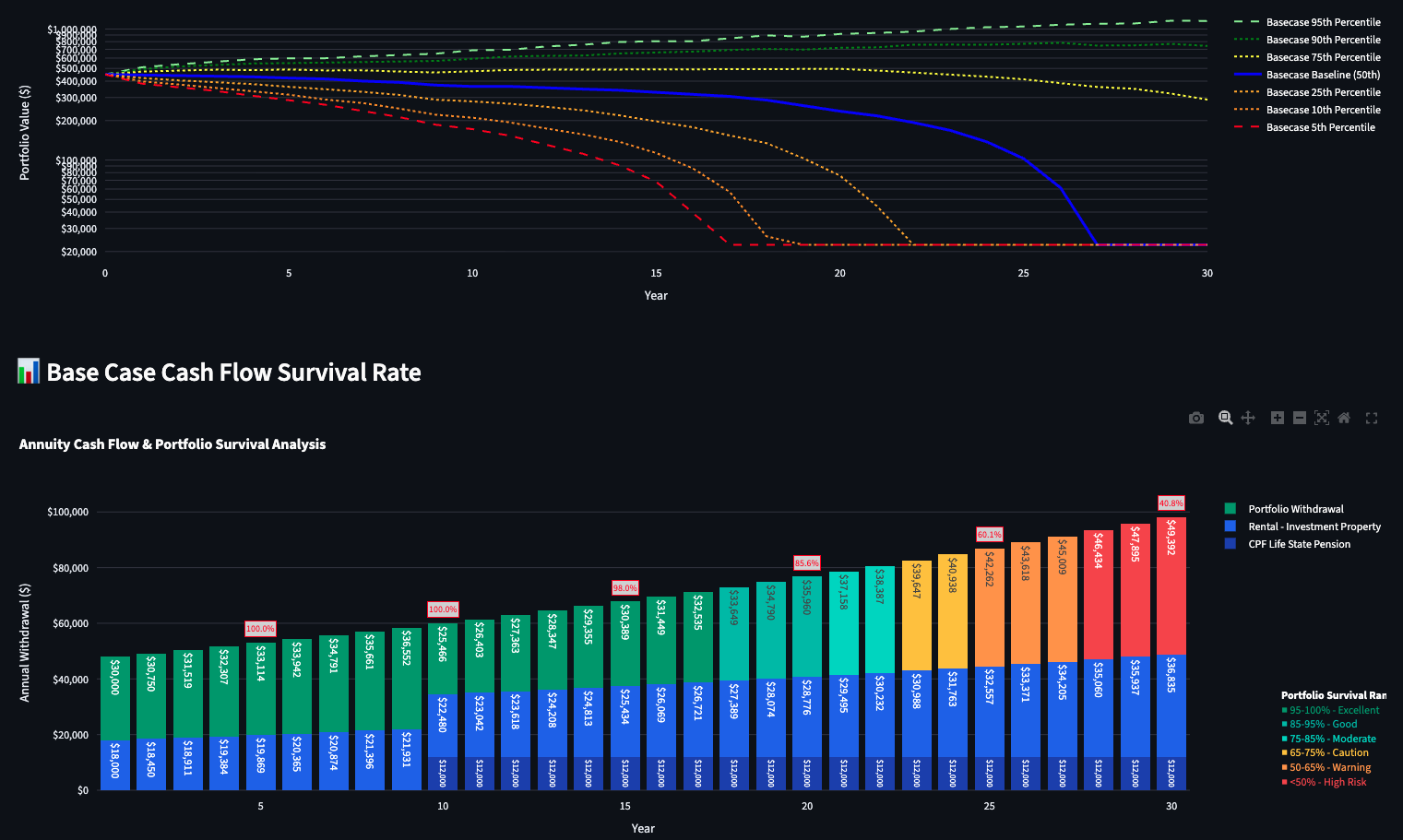

Case Study: Nelson & Family – "Can We Retire at 55?"

📋 Profile

Nelson Tan (55), married, accounting professional in Singapore.

💰 Assets & Income

- Home: Fully-owned HDB flat (primary residence).

- Investment Property: A partially-paid private shoebox apartment. Provides $18,000/year after-tax income, growing with inflation (2.5% p.a.).

- Pension: CPF Life set aside. Will pay $12,000/year starting at age 65.

- Portfolio: A $450,000 nest egg in a balanced portfolio (50% Global Equities / 50% Local Bonds).

❓ The Big Question

Can Nelson retire now with annual living expenses of $48,000 ($4,000 per month)?

📊 The Traditional Answer (Linear Forecast)

Using steady, risk-free returns, their assets would fund a comfortable retirement until Nelson turns 85. (See the 'Expected Returns' tab).

This looks great on paper: A smooth, reassuring line showing money lasting 30 years. Most retirement calculators stop here.

🎲 The RetireSim Reality (Probabilistic Forecast)

When we model thousands of realistic market scenarios with ups and downs, a crucial risk emerges.

⚠️ Critical Finding

There is a 20% chance the portfolio could be exhausted up to 9 years earlier.

This means in 1 out of 5 possible market scenarios, Nelson could run out of money by age 76 instead of 85 - a significant risk that linear forecasts completely miss.

What drives this risk? The biggest danger is sequence-of-returns risk - if a major market crash occurs in the first 5-10 years of retirement, Nelson would be forced to sell investments at depressed prices to cover living expenses, permanently reducing his portfolio's ability to recover.

Discover the full analysis: See the range of possible outcomes and what drives this risk in the 'Monte Carlo' tab.

Run Nelson's Scenario in the Simulator →

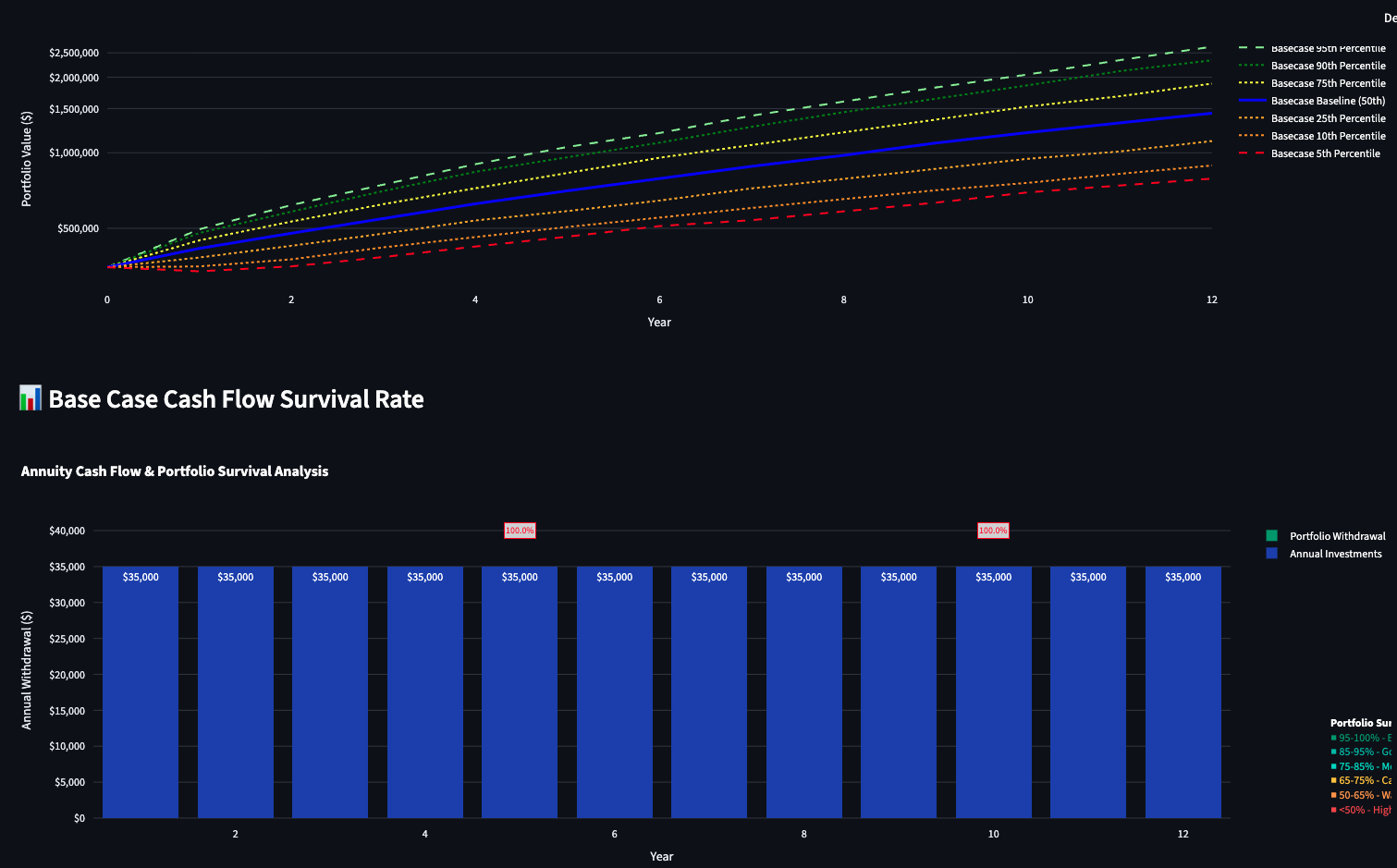

Case Study: Emma Clark – Digital Nomad Chasing FIRE by 45

📋 Profile

Emma Clark (33), single, digital nomad and FIRE (Financial Independence, Retire Early) enthusiast.

She works remotely as a freelance software developer, leveraging geo-arbitrage to minimize expenses while traveling through Southeast Asia and Europe.

🎯 The Aggressive Plan

- Current Portfolio: $350,000 in a globally diversified, equity-heavy portfolio (90% Global Equities / 10% Bonds).

- Savings Rate: Puts aside $35,000 annually from her high freelance income.

- FIRE Target: Aims to accumulate a $1.5 million portfolio by age 45 (12 years from now) to fund a permanently sustainable retirement.

❓ The Core Question

Can her current savings rate and aggressive investment strategy realistically hit her $1.5M target in 12 years? What is the probability of success, and what are the key risks?

📊 The Linear Forecast (Naive Optimism)

Assuming a steady, above-average annual return (e.g., 8%), her portfolio would surpass the $1.5M target just before age 45. This simple projection makes her goal seem easily within reach. (See the 'Expected Returns' tab).

This is what typical FIRE calculators show: A smooth upward curve hitting your target right on schedule. But is it realistic?

🎲 The RetireSim Reality (Market Volatility)

When we stress-test her plan against thousands of realistic market scenarios—including potential bear markets, sequence of returns risk, and variable inflation during her critical savings years—the picture becomes more nuanced.

⚠️ Sobering Reality

Analysis shows only a 50% probability of reaching her goal by 45.

It's a coin flip - half of market scenarios get her to $1.5M on time, half don't.

❌ Worst Case Scenarios

In 10% of market scenarios, she could fall short by $600,000 or more.

A major bear market during her late 30s or early 40s could significantly delay her FIRE date, potentially by 5-7 years.

Why such high variance? Emma's aggressive 90/10 allocation amplifies both gains AND losses. During accumulation years, market crashes hurt, but she can dollar-cost-average and buy the dip. However, a prolonged bear market in her early 40s - when her portfolio is largest - could substantially delay reaching her target.

Discover the full analysis: Explore the range of outcomes, the impact of market crashes during her savings phase, and potential levers (savings rate, asset allocation) in the 'Monte Carlo' tab.

Run Emma's Scenario in the Simulator →